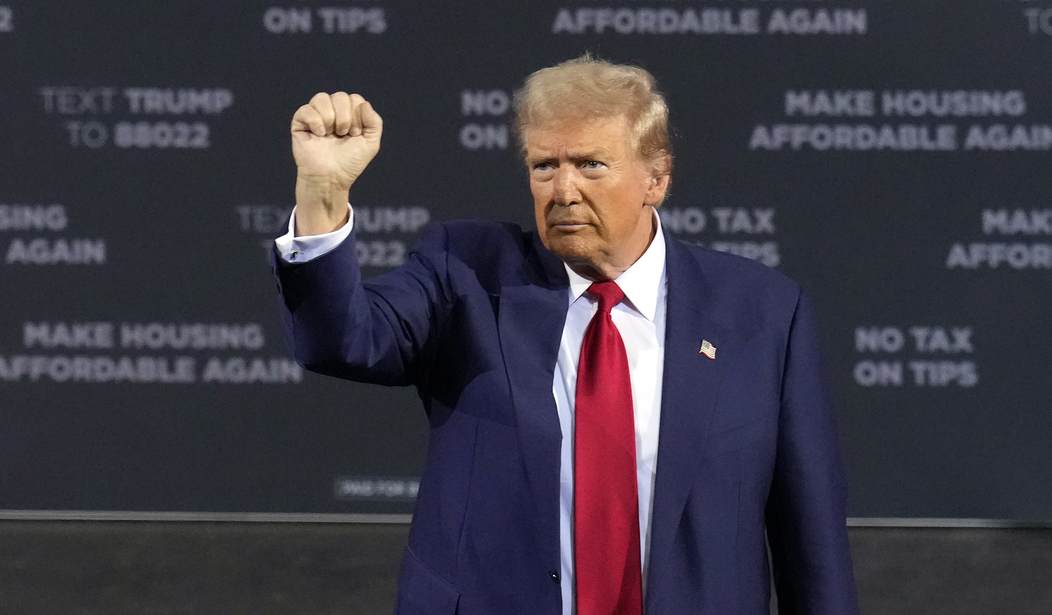

Less than two months before the 2024 election, the race is close, with voters split between former President Donald Trump and Vice President Kamala Harris.

However, there seems to be a consensus that the economy is among voters' top issues, and according to polls, the majority trust Trump more to get the country back on track.

A recent Wall Street Journal poll found that 83 percent of registered voters either strongly or somewhat favor Trump’s proposal to end taxes on Social Security benefits. Sixty-four percent of respondents said they “strongly favored” cutting taxes on Social Security benefits, and 19 percent said they “somewhat” favor the policy. Just ten percent opposed it.

The WSJ found that 16 percent of American households would benefit from Trump’s tax cut proposal, saving them about $3,400.

The income tax on benefits hit 50% of Social Security recipients in 2023, according to the Social Security Administration, up from 10% when Congress created the tax in 1983. Many retirees are surprised when they learn about the tax liability, and surveys show the Trump proposal has touched a nerve. Social Security recipients must calculate their income, adding in half of their benefits. If that total income exceeds $25,000 ($32,000 for married couples filing jointly), up to half of benefits are taxed. If it exceeds $34,000 ($44,000 for married couples), up to 85% of benefits are taxed. That system can create high marginal tax rates for working Social Security recipients because they simultaneously face regular taxes and taxes on more of their benefits as income goes up.

Income taxes on benefits now make up about 4% of Social Security’s revenue, and repealing the tax would hasten the day when the program can’t pay full benefits. Congress raised the tax in 1993 and directed that money to Medicare. Lawmakers intentionally set income thresholds for the tax without inflation adjustments, and it affects more people over time. Beneficiaries who pay the tax generally have wage or investment income beyond Social Security.

Recommended

Trump has also proposed ending all taxes on non-salaried employees who work more than 40 hours a week, giving people, such as service workers and nurses, more incentive to work harder in return for more money in their paychecks.

He also discussed banning taxes on tips and his economic policy should Trump be elected.

Under the Biden-Harris Administration, inflation is up 19.7 percent, food prices are up 21.8 percent, and home prices are up 22.7 percent—all up by double digits since Biden took office.

A recent CNN poll found that voters believe Trump can do more to repair the economy than Harris by, on average, eight points.

Join the conversation as a VIP Member