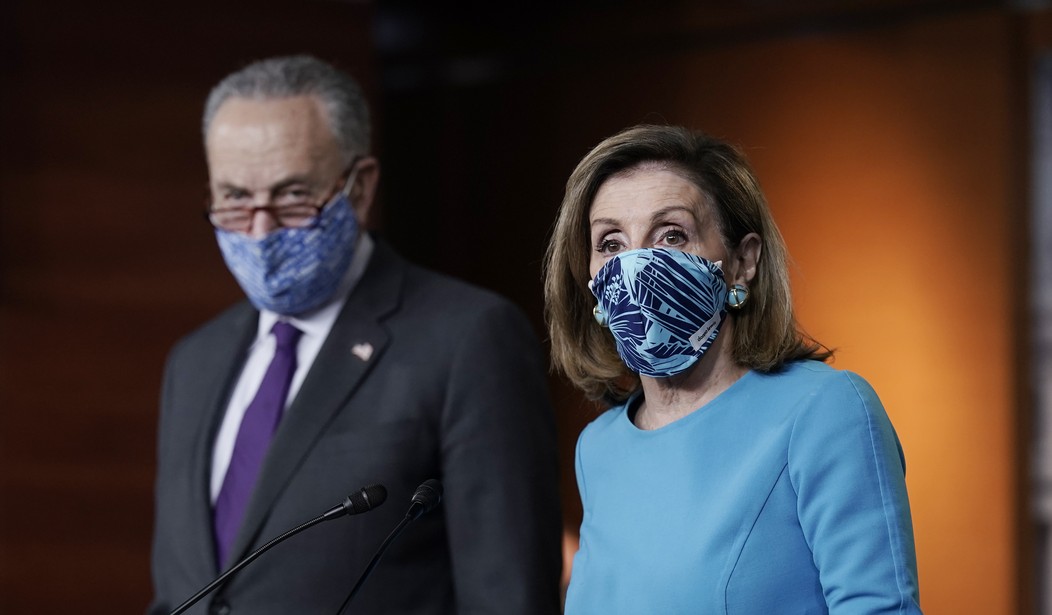

Republicans warned that only a small percentage of the American Rescue Plan was actually going toward Covid-19 relief, and that the rest is filled with pork, far-left policies, and bailouts—hence why it passed on a party-line vote.

One provision in the $1.9 trillion legislation that’s now coming under scrutiny is the $86 billion bailout for failing pensions. As The New York Times reports, taxpayer money is going towards problems that existed prior to the pandemic.

Tucked inside the $1.9 trillion stimulus bill that cleared the Senate on Saturday is an $86 billion aid package that has nothing to do with the pandemic.

Rather, the $86 billion is a taxpayer bailout for about 185 union pension plans that are so close to collapse that without the rescue, more than a million retired truck drivers, retail clerks, builders and others could be forced to forgo retirement income.

The bailout targets multiemployer pension plans, which bring groups of companies together with a union to provide guaranteed benefits. All told, about 1,400 of the plans cover about 10.7 million active and retired workers, often in fields like construction or entertainment where the workers move from job to job. As the work force ages, an alarming number of the plans are running out of money. The trend predated the pandemic and is a result of fading unions, serial bankruptcies and the misplaced hope that investment income would foot most of the bill so that employers and workers wouldn’t have to. (NYT)

What's even more appalling? "The provision does not require the plans to pay back the bailout, freeze accruals or to end the practices that led to their current distress, which means their troubles could recur. Nor does it explain what will happen when the taxpayer money runs out 30 years from now."

Recommended

That led some to argue that not only is the Covid "relief" bill "the biggest single act of corruption in U.S. history," but that this bailout provision alone is a "massive scandal."

"The provision does not require the plans to pay back the bailout, freeze accruals or end the practices that led to their current distress"

— steve hilton (@SteveHiltonx) March 9, 2021

this ON ITS OWN is a massive scandal. Biden's Bailout Bill is the biggest single act of corruption in U.S. historyhttps://t.co/CMTttpO3Uf

Washington spending $86 billion to bail out *private* pensions is a strong indicator of how Congress will respond to the SocSec & Medicare trust funds hitting zero - no reforms, just permanent bailouts. That's how you get $100 trillion in 30-year deficits.https://t.co/BSehLTw0QW

— Brian Riedl ?? (@Brian_Riedl) March 9, 2021

"Using taxpayer dollars to bail out pension plans is almost unheard-of. "https://t.co/UtXyreYIUD

— Ann Coulter (@AnnCoulter) March 8, 2021

Unfortunately, the backlash is too little too late, as President Biden is expected to sign the legislation this week.

Join the conversation as a VIP Member