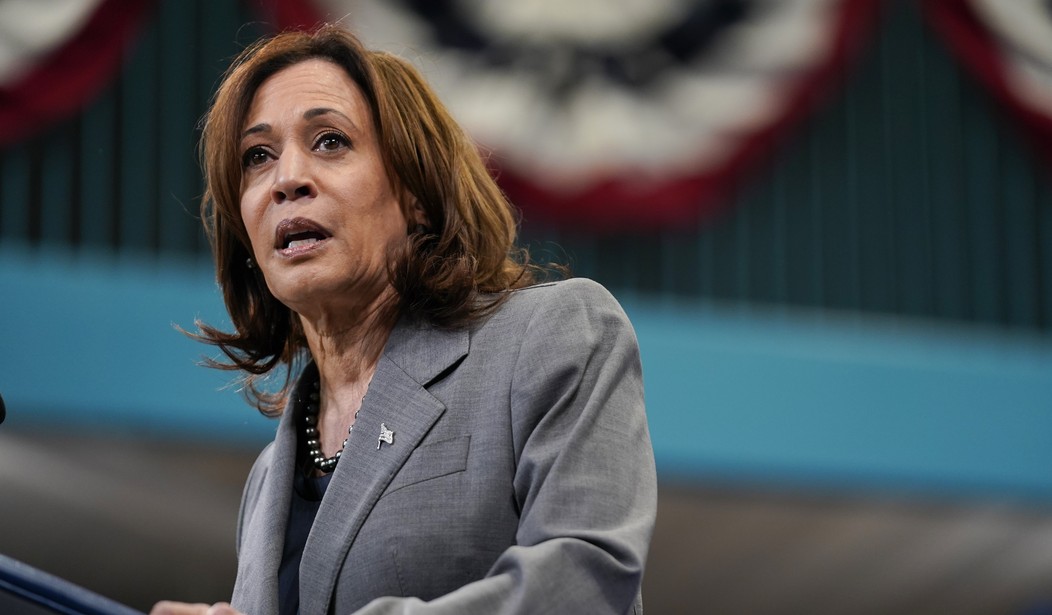

Kamala Harris wants government to help first-time homebuyers by making the age-old mistake of using government subsidies. What she should have learned from her economics and history classes, however, is that government subsidies uniformly fail – a fact proven by America’s dangerous education debt crisis.

On the one hand, we have to give Kamala Harris some credit for being honest. She has refused to answer any questions about her policies in the face of criticism about her past liberal views. Despite that, her first policy proposals turned out to be every bit as liberal as people warned she was – if not more.

For instance, Madam Deficit, as I refer to her, has proposed to provide first-time home buyers with a $25,000 government check to use toward a home purchase. Of course, that would add to the national debt, which is already soaring above $35 trillion and, along with $2 trillion annual deficits, is directly leading to inflation.

Inflation, of course, results in higher interest rates. In turn, higher interest rates increase the costs of purchasing homes. As such, Harris’ “fix” to that is to make the home affordability crisis even worse.

Beyond that, however, Harris’ program fails basic economics.

When government artificially increases demand through subsidies prices tend to increase – that is dictated by the economics law of supply and demand.

There is no greater example of that in American history than America’s education debt crisis.

Currently, the office of Federal Student Aid boasts that it “provides approximately $114.1 billion in grant, work-study, and loan funds each year to help students and their families pay for college or career school.”

Recommended

Those subsidies, which have been provided for decades, if only in lesser amounts, by definition, increase the demand for higher education. While there are benefits to increased higher education, there are other effects to those government expenditures.

Consider this: “A 2015 study by scholars at the New York Federal Reserve Bank looked at the statistical relationship between college tuition and federal grants and loans. They found that ‘institutions more exposed to changes in the subsidized federal loan program increases.’"

Normally, as the price of a product or service increases, there tends to be fewer buyers of the more expensive products or services. However, when government gives away taxpayer dollars to the consumers, that important connect between supply and demand diminishes.

As a result, the price of higher education has steadily risen over the years – but that is not all.

The world now knows of the education debt crisis of America. According to LendingTree.com, “Americans owe $1.74 trillion in federal and private student loan debt as of the second quarter of 2024.” However, many of the consumers of those loans cannot find jobs to pay back those loans.

Stated plainly, that is a dangerous crisis induced by government.

Now, of course, there are cries by many politicians to “forgive” those loans. Really what they are saying is that they want to release those consumers of their debt and then pile that debt on top of the national debt. Read – they want to create even more inflation.

If that ever occurred, that would result in an even greater demand for student loans, and therefore higher tuition costs, because those consumers would come to believe the loans were “free” money.

The student loan debt crisis isn’t the only such government-induced crisis in American history. Beginning under the Clinton administration and then continuing under President Bush, government effectively subsidized housing purchases. Indeed, “In January 1993, the 1992 housing bill required Fannie and Freddie to make 30% of their mortgage purchases affordable-housing loans,” AEI explained. “The quota was raised to 40% in 1996, 42% in 1997, and in 2000 the Department of Housing and Urban Development ordered the quota raised to 50%.”

The short-term effect of the programs was to increase the home ownership rate from 64% in 1993 to 69% in 2004. Sounds good, right? After all, Madam Deficit Harris declared the benefits of home ownership in her speech extolling the needs of her $25,000 subsidies.

What followed the Clinton/Bush policies, however, which included easing regulations that allowed for previously unworthy credit risk loans, was the subprime lending financial crisis. According to the Federal Reserve, “The expansion of mortgages to high-risk borrowers, coupled with rising home prices, contributed to a period of turmoil in financial markets that lasted from 2007 to 2010” —oh, and hundreds of billions in federal bailouts.

For those keeping count, that’s two major subsidy programs leading to higher prices and two severe crises. You would think the nation is smart enough not to do that again.

If only Madam Deficit Harris had paid attention to those events. Then again, big government proponents generally do not and will not. On November 5th, we shall find out whether voters know better than Madam Deficit.

Thomas G. Del Beccaro is the Author of “The Lessons of the American Civilization” and “The Divided Era.”

Join the conversation as a VIP Member