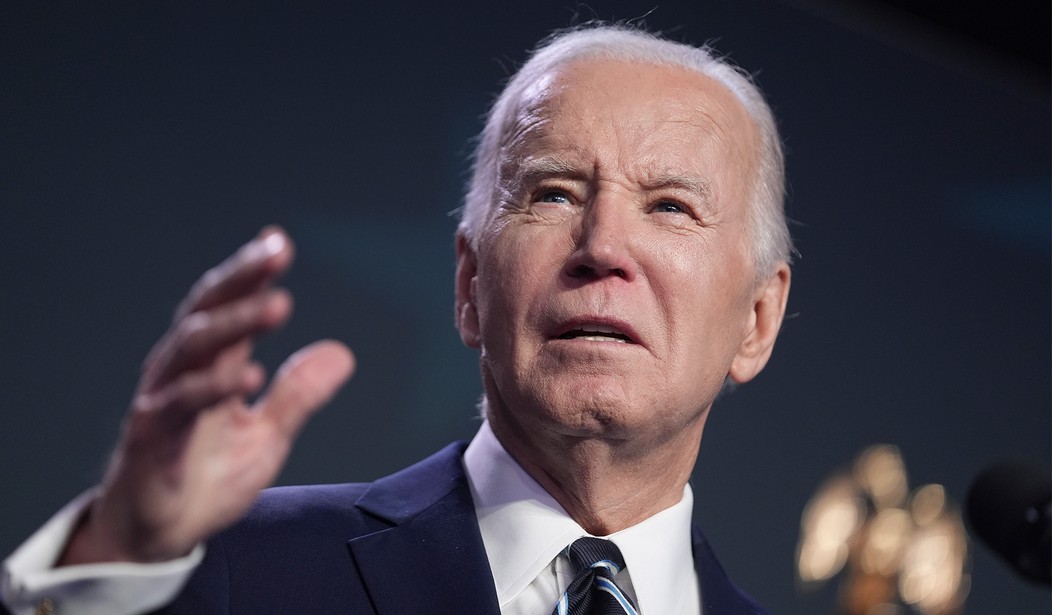

President Joe Biden is boasting about the recent stock market rally. He's right that stocks have been on a tear for the last 14 months. The S&P 500 hit 5,000 for the first time in history. That's up from 500 some 30 years ago.

Even with all our problems, the United States is the unrivaled alpha male nation. The dollar is the only currency that matters globally (the Euro and BRICS are weak little sisters), and for the first time, the U.S. economy produces far more than all of socialist Europe combined. Our Magnificent Seven technology firms -- Amazon, Apple, Google, Nvidia, Meta, Microsoft and Tesla -- are close to being worth more than all of the stocks combined in any other country, with the exception of China.

But the Biden bull stock market story isn't all it's cracked up to be. Most of the gains in the market have only made up for the miserable returns in Biden's disastrous first two years in office when stocks lost almost 15% of their value. In other words, for the most part, the last 14 months have simply made up for the lost ground during the 2022 rout in stocks.

Yes, it's true that in nominal terms stocks are at record highs. But one of the first rules of investing is that you need to pay attention to your after-inflation profits. If you make an investment in a widget company and in 10 years that stock has doubled in value but the price level in dollars of everything else has doubled, sorry, you're no better off based on what you can buy with those profits.

Recommended

So, let's see what has happened to stocks over the first three years of the Biden presidency -- i.e, through the end of January 2024.

Over that period, the price level has risen by about 18%. The real (inflation-adjusted) rate of return in the S&P 500 after three years of Biden is thus only 8%. This is fairly anemic and well below the average annual real rate of return since the New York Stock Exchange opened its doors, which is a three-year average of more than 20%.

Biden's performance is also much worse than the bull market under Donald Trump. The S&P was up 36% in real terms at this time of Trump's presidency, or more than four times better.

Trump has made the case that the rise in the stock market in recent months is a result of the higher likelihood that he will be elected in November. I don't put too much stock in that claim. If the stock market tanks, is he responsible for that, too?

However, an analysis by ace investor Scott Bessent and a member of the Committee to Unleash Prosperity economic council finds that fluctuations in the stock market over the past year HAVE correlated positively with the betting market odds that Trump will win. Right now, he stands at just above 50%. This relationship could be spurious, and of course, by far the biggest factor that drives stock valuations is profits.

One last piece of investment advice: Investors should pay attention to the Democratic agenda if they win in November. The Biden economic plan calls for doubling the capital gains tax, taxing unrealized capital gains and raising both the corporate tax rate and the dividend tax. That is very bad news for sure for stocks. And THAT, you can take to the bank.

Join the conversation as a VIP Member