Now, it is the Senate’s turn to load up the Budget Reconciliation bill with good tax provisions before the package goes back to the House of Representatives. There is an opportunity for the Senate to add something called the GROWTH Act to the Senate version of President Donald J. Trump’s Big, Beautiful Bill which will promote savings and investment for retirement. Right now, taxpayers who invest in mutual funds are hit with a surprise tax bill every year if they choose to keep their mutual fund gains in their account. This is unfair and needs to be addressed.

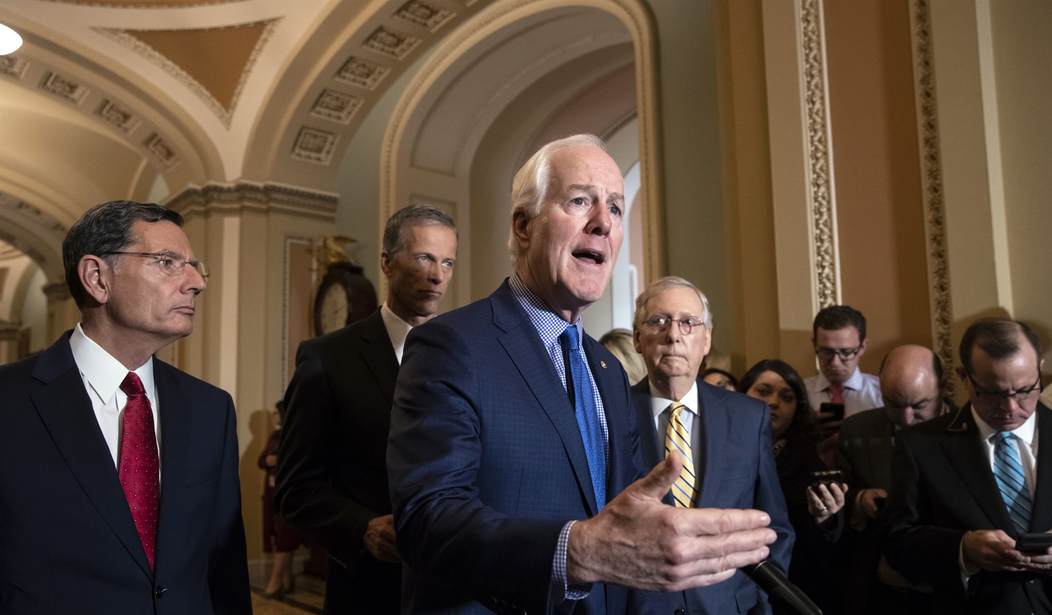

By adding this provision, the Senate will make the bill even more beautiful. CNBC reported on May 23, 2025, “Sen. John Cornyn (R-TX) this week introduced a bill, known as the Generate Retirement Ownership Through Long-Term Holding, or GROWTH, Act.” Sen. Cornyn could make a push to drop this bill into the larger Trump tax package when the Senate considers it in the coming days. The Senate will surely battle over Medicaid reforms and personal SALT tax deductions, yet dropping in the language of the GROWTH Act would be largely non-controversial.

The idea memorialized in the legislation is a simple one. The bill would “defer reinvested mutual fund capital gains taxes until investors sell their shares.” In other words, if an investor chooses to keep funds in a mutual fund, right now they get hit with a tax bill annually, even though they have never put their hands on the profits from the fund nor do they have access to any additional liquid funds.

Mutual funds are very popular. It is estimated that over half of American households own mutual funds, known as ETFs, and over three-fourths of them are holding the funds for retirement. Employer-sponsored plans are the bulk of these plans held today. When you look at the numbers, Senators should take note. Over 120 million Americans rely on these funds for retirement and investment.

The idea of surprise capital gains taxes may make sense to tax collectors but makes absolutely no sense to the American people. Mutual funds buy and sell assets every day. When the fund sells assets for a profit in an investor’s portfolio, they are required by law to distribute gains to shareholders at the end of the year. This distribution causes a taxable event where the investor, who never deposits the gains in their account, gets an unwelcome surprise call from their tax accountant. Most investors want to hold and reinvest any distribution, yet the Internal Revenue Service forces them to pay taxes on these unrealized gains. Addressing can be easily accomplished in the current tax measure being considered by the Senate in the next few weeks.

Recommended

This is a working- and middle-class issue where the bulk of the holders of these plans will be watching this debate closely. These funds have been growing as employers offer more and more options for employee retirement. They are popular because they are successful options for those wanting a safe investment for the future. The fact that the IRS punishes these plans is unconscionable and a deterrent to investment.

This is one of the few non-controversial issues that should be acceptable to the House of Representatives if sent back as part of the bill. Representatives Beth Van Duyne (R-TX) and Terri Sewell (D-AL) sponsored the GROWTH Act in the House, so this idea has bipartisan support. It is not controversial and could easily be addressed while Congress is crafting a landmark tax reform bill.

Government programs like Social Security are at the breaking point and Americans want options to ensure they have an adequately funded future retirement. Not many believe that the current trajectory of government debt, accelerated by a growth in mandatory spending and interest, is sustainable. It makes sense that American families invest in private retirement options to make sure they have a nest egg when they retire, rather than relying on the federal government to take care of them.

Congress has a once in a lifetime opportunity to clean up the tax code. President Trump pushed hard to eliminate taxes on tips, overtime, and Social Security. The Senate should take action to end the surprise capital gains tax that hits unsuspecting investors in mutual funds every year during tax season.

Join the conversation as a VIP Member