When my husband and I first started our lives together we were like most young couples - underemployed, hopeful and naive. Our credit situation was…eclectic to say the least. His had been damaged from years of youthful abuse and few unfortunate situations that were no fault of his own. I had almost no credit at all.

We lived in an economically depressed, inner city community with all the typical hallmarks - high crime, high unemployment and low property value. By the time we were financially secure enough to take on a mortgage our credit woes had caught up to us. We were doing fine but on paper our credit history was a mess. No “reputable” bank would lend to us. It wasn’t just our credit that was an issue - we were a young, black couple living in a high-crime area. Let’s just say we weren’t the ideal candidates for Mr. Big Bank to invest in.

We ended up going with a sub-prime lender. The rate was high but we understood what we were getting into. We did the math and figured out how long we could sustain such a mortgage until we could clean up our credit and refinance. We weren’t naive about it. We went into it fully informed and came out with a dilapidated but promising home that we spent five years renovating piece by piece. It was where we started our family, hosted our friends and had some of the best times of our lives. It was the genesis of our American Dream.

I say all this because the subprime lending market gets a bad rap, as if it alone were responsible for the financial woes of lower income Americans. Often subprime loans are seen as predatory. To people like me and my husband they were a gift.

I recently became aware of a bill in California that would make access to sub-prime lending even more difficult for people who are in the position we were all those years ago. AB-539 is currently weaving through the legislature in Sacramento. The intention seems to be to “protect” low-income consumers from predatory lending by driving most short-term lenders out of the state.

Recommended

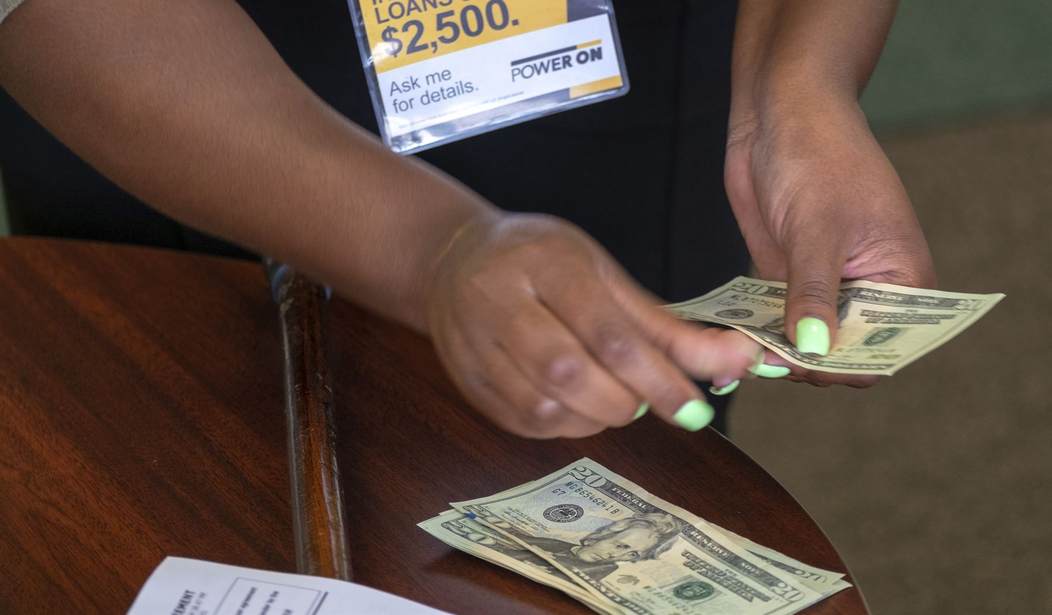

My husband and I availed ourselves of a long-term sub-prime mortgage but more often people like us aren’t looking for mortgages, they’re looking for short-term loans to get them through a rough time or help with unexpected expenses.

It’s no secret that in California the cost of living has become nearly untenable for most families. According to a recent study, 38% of Californians would not be able to meet their most basic needs for even three months were an unexpected financial burden to come their way. Anecdotally speaking I suspect that number is much higher. Even in my quiet Orange County suburb most people are living paycheck to paycheck. If there’s one thing this state does well it’s squelching growth.

With the shocking income disparity getting even worse, Sacramento has been pressured to makes moves to protect low-income consumers. In a misguided attempt to do that, they’ve instead limited access to short-term lending that can sometimes be the only lifeline for a family in trouble.

California has a large Hispanic/Latino immigrant population. It should come as no surprise that three of five Latino families in our state live in what is called “liquid asset poverty” - that is, were they to experience some sort of financial emergency they would have nothing to liquidate to help cover living expenses.

A high-interest, short term loan might not seem like a “gift” to those who don’t share the same financial worries, but when you’re a minority with poor or no credit it can sometimes be a lifesaver. With no extended family to depend on, limited income, and no assets, a short term loan can be the difference between complete disaster and survival.

Alice Huffman - President of the California-Hawaii State Conference of the NAACP says that Black Americans will also be heavily affected, driving them and others in the same position to even less ideal options.

"In spite of national trends, a study by the Center for the New Middle Class shows African-Americans are much more likely to have experienced a drop in pay or work hours in the past five years when compared to their peers. The study also shows African-Americans are 28 percent less likely to have $1,200 for a financial emergency and 80 percent say they live paycheck-to-paycheck.

"Without widely accessible small-dollar loan options, families will either be unable to meet their financial obligations, or will resort to costlier or less regulated options, such as overdrafting on their bank accounts or resorting to borrowing from offshore, illegal lenders who are not regulated by the state."

There are many responsible, licensed short-term lenders in our state with a great track record of offering assistance to low-income families during stressful crises. It is a legitimate consumer-provider relationship that shouldn’t be punished. Not only does that punishment affect jobs in our state, it affects those who live on the lowest rungs of our economic ladder. We’re talking about people who can’t avail themselves of the privilege of connections or affluence to access mainstream credit. They deserve access, too.

As usual the state legislature is treating the symptoms rather than the disease. It’s an issue far too nuanced to solve with one bill or one op-ed column, but until the politicians are willing to release the free market to bring down the insane cost of living, the necessity of the sub-prime lending market will be a vital part of California life.

I’ll be urging my state representatives to vote “No” on AB-539, and I’ll be doing it for every person out there who is like we once were - hopeful, maybe a bit naive, but not asking for much more than a shot at participating in the American Dream.

Join the conversation as a VIP Member