To call the Biden administration’s economic policy disastrous might be an insult to disasters. Following the unprecedented economic growth we all enjoyed under President Trump, Biden has done all he can to sabotage the American economy.

The Democrats’ spending spree has presaged record inflation. Their attack on domestic energy has doubled energy costs for all but Biden’s elitist, electric car-driving base. Social Security beneficiaries are hurting, and nonprofits are struggling to keep up with the skyrocketing rates of newly impoverished under Biden.

At a time like this, red state governments need to do as much as they can to protect their constituencies. It seems to mostly be working – of the top 10 state economies, only two are blue states – but some states seem to be caving.

Several red states are struggling to remember that tax cuts are usually net revenue generators.

For example, lawmakers in North Carolina are considering “offsetting” proposed cuts to the state income tax by legalizing commercial gaming. Likewise, Texas – No. 8 on that list of top state economies – wants to increase sales tax to offset a property tax cut. Georgia wants to cut income tax, but offset by taxes increases elsewhere.

It’s such a perplexing trend that the Conservative Political Action Coalition (CPAC) had to issue a message to red states trying to pass tax cuts this year. Their message? Just pass tax cuts without special interest giveaways.

“The budget bill is the result of backroom dealings where only select special interest groups had the privilege of negotiating. If North Carolina is to expand gaming, it should do it outside the budget negotiation, and not subject the state to a lobbyist-created monopoly,” the letter reads. “Conservatives understand that we can cut taxes without raising revenue elsewhere. Give the people back their money, allow them to spend it, and watch your economy grow.”

Recommended

The economic benefit of lower taxes is replete throughout history, from Calvin Coolidge to Ronald Reagan to Trump. Here in my home state, Utah, the state Legislature gave us a $160 million this year, which will help keep us at No. 1 on that list of top state economies.

Tax cuts leave more money in people’s hands, money they can use to go to school, invest in a business, buy a house, and on and on. This spurs economic growth and creates – ta da! – more tax revenue. The only people who benefit from punitive tax rates are the people taking the money. It’s not a surprise that of the seven richest counties in America, five are in the DC area.

Remember, Robin Hood didn’t actually “rob from the rich and give to the poor,” he reclaimed money that had been immorally taxed and gave it back to the people it had been robbed from.

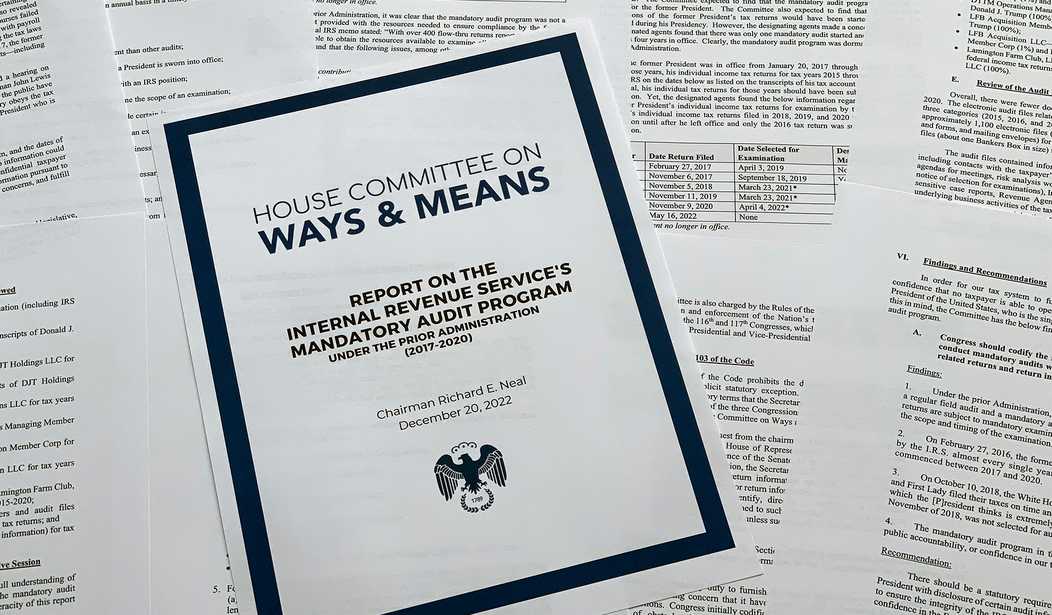

Moreover, higher taxes incentivize tax evasion tactics like offshore banking, concealing assets, manipulating the tax system, and just plain lying. More attractive tax rates attract money, more important now than ever in the world of internationally fungible finances.

The state with a tax policy so good it’s been called an “onshore tax haven” is Delaware … Biden’s home state.

If American tax rates become too aggressive, places like Singapore or Dubai would be delighted to make a home for American money. Now, since Biden took office, more than 20 countries have abandoned the petrodollar, hurting the finances of the average American even more.

Going into 2024, economic policies will be critical for illustrating the difference between Democrats and Republicans – should the latter want to save their jobs (and incidentally America). Despite all the hand-wringing about how horrible President Trump would be, the economy roared under him while it is withering under Biden.

He can lie about how his economy is “strong as hell” and Democrat-lapdog media can try to twist the numbers for him, so Republicans have their work cut out for them. Now’s the time to stand strong, not to lose faith.

Join the conversation as a VIP Member