There’s an old saying in Washington that, “Democrats have never met a tax they didn’t like.” Part of it is because they need capital to pay for their never-ending litany of social programs, bridges to nowhere, indoctrination efforts, and paybacks to campaign donors. At this point though, it seems like their motivation for hitting Americans with new taxes is just spite.

Their latest one is the insane announcement that they want to tax unrealized gains – that is, they want to steal money that hasn’t actually been made yet from people who don’t technically have access to it. Insane, but completely politically inviable.

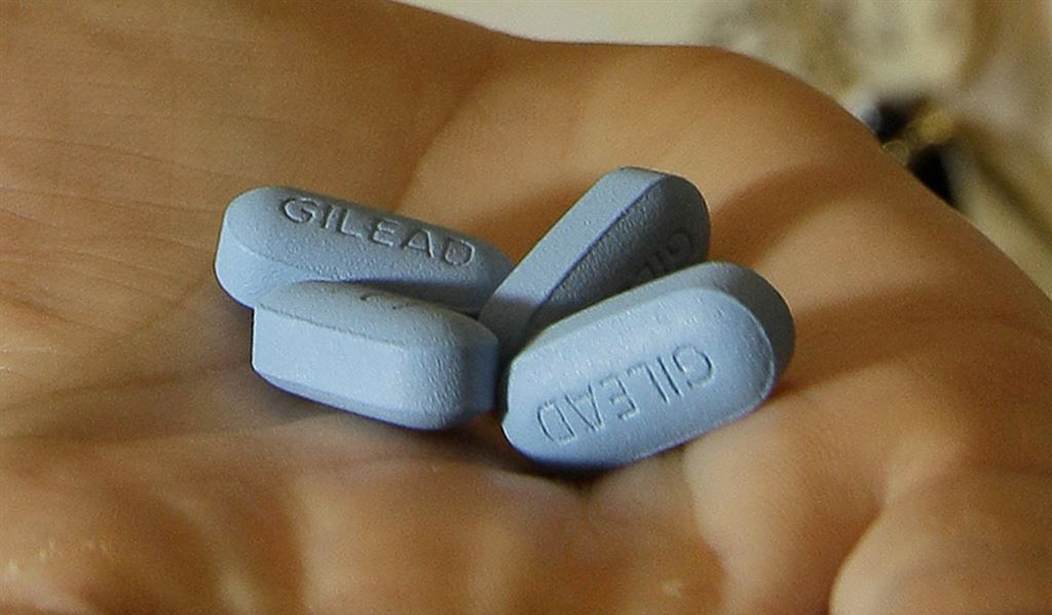

Slightly less crazy – but much more scary because they might be able to sneak it into law – is Speaker Nany Pelosi’s so-called Lower Drug Costs Now Act. Democrats are, spoiler alert, no friend to the industry that churns out our life-saving, quality of life-improving medicines. Private equity investors – many of them from her home state of California and hometown of San Francisco – are lobbying against Pelosi’s reckless bill, urging her legislative aides in private meetings that the plan would dry up financing for small biotech companies.

Small biotech start-ups lead 70 percent of clinical trials, according to the CBO. Without money from private investors, these companies couldn’t possibly overcome the enormous risk and burden of bringing new drugs to market.

HR 3 demands drug manufacturers to participate in negotiations on the price of their medicine, or at least agree to a negotiated price. If they don’t, the drug in question will be hit with an escalating excise tax – the kind of thing usually reserved for alcohol and tobacco. It would start at 65 percent, according to most reporting, and rise by 10 percentage points each 90 days of “noncompliance,” eventually reaching 95 percent.

Recommended

But looking a little bit more in the bill – which one supposes we have to pass before we can find out what’s in it – the text of HR 3 opens it up even higher. Rather than describing the applicable rate applying to sales, the text is slyly enough written that this new excise tax rate could reach a maximum of 1,900 percent.

Republicans are justifying their opposition with a report from the nonpartisan Congressional Budget Office that determined HR 3 would cut the number of new drugs coming to market by eight to 15 over 10 years. Trade group PhRMA gave a much grimmer estimate with 56 fewer medicines. But the White House – which should be behind Pelosi? – claims it could be 100.

Whether it’s eight or 100, if any one of those drugs, pardon the expression, gets canceled by the woke mob, some people will suffer. If any one of those drugs that might be developed were to, say, cure the coronavirus, then the whole world would suffer.

Pelosi’s cheerleaders over at CNBC are defending the bill, even while acknowledging the same fear from investors, that HR3 would save Medicare $345 billion! … over the next decade. That certainly sounds like a big number, but keep in mind that $3.45 billion per year in Washington is not a lot of money – it’s nothing compared to the benefit of 100 new drugs, either from the standpoint of public health or the economy.

New medicine is an economic boon to the research capitals of our country and those who wisely invest in them. Speaker Pelosi’s own San Francisco has benefited endlessly from American capitalism but keep voting to destroy it. While free enterprise has unleashed every medical advancement of the last 100 years – with appropriate government guardrails – there are an increasing number of people who treat free enterprise like the villain.

The health care system needs more free-market momentum, not less. More competition means more choices, lower prices, and more drive to please the customer. Innovation tends to work better than government brutality, which is why people flee socialist countries to come to capitalist ones. HR 3 might make a few anecdotal improvements here and there, but it would mostly punish innovators, muddle the marketplace, and hurt the people the Democrats say they’re helping.

The Democrats never met a tax they didn’t like, and at this point – given how radicalized they have become – they don’t care who gets hurt along the way. They and their lapdog press will insist their new taxes are just for billionaires, but we all know that’s a lie. Crazy taxes on our health care will not make us healthier.

Join the conversation as a VIP Member