Most people simply hate stocks.

According to a June 2012 survey conducted by the University of Chicago and Northwestern University, 84% of respondents say the stock market is untrustworthy and that it's foolish to put your money into stocks.

I can see their point. Bernard Madoff may be the poster child for Wall Street fraud -- but he's got plenty of company.

Even if Wall Street could clean up its act, it's easy to understand why investors take a dim view toward stocks: The S&P 500 is actually 15% lower than where it stood five years ago. In fact, it's lower than where it stood back in 2000. Cash under the mattress would have been a better investment.

But I think there's a better way to look at things. After all, over longer time frames, stocks perform quite well. Even though the last 10 years could be considered a "lost decade" for stocks, the S&P 500 has moved from below 200 in 1985 to above 1,400 today -- a gain of more than 600% over 25 years.

That's cold comfort for investors right now. At the moment, our economy looks weak, and the rest of the world looks even worse. That's why investors have their heads tucked between their legs, bracing for the impact of another crash.

But don't count on such a dire outcome coming to pass. If history is any guide, stocks will likely be higher five or 10 years from now, and your retirement portfolio can finally start to make major progress.

You could invest in the stock market via an index fund, but I think you can do even better by investing in "safe stocks."

That's because while I think stocks in general will be much higher a decade from now, the market could suffer some scary plunges along the way. To protect yourself from the gut-wrenching volatility, it's wisest to focus on "safe stocks."

Recommended

That term should be used a bit loosely, as no stock is immune from falling in value. But if you know where to look, you can find an entire class of stocks that have proven their mettle, through good economies and bad. These stocks are likely to deliver quiet and steady gains rather than neck-snapping spikes and plunges.

[InvestingAnswers Feature: The 5 Best Dividend Aristocrat Stocks For A Retiree's Portfolio]

My safe stocks share one trait: They all have a history of producing positive free cash flow -- in any economic climate.

I went back over 10 years' worth of data and -- out of the 900 stocks in the S&P 500 Index and the S&P Mid-Cap 400 Index -- I found fewer than 100 stocks that never generated negative free cash flow during that time. Apologies to Microsoft (Nasdaq: MSFT), Visa (NYSE: V) and Applied Materials (Nasdaq: AMAT), great companies that had just one year of negative free cash flow in the past 10 years and therefore didn't make the cut.

So why is free cash flow the best measure of safety?

Let me use the "Good Humor truck" example to illustrate why free cash flow is the real measure of a company's quality.

Let's say you spend $5,000 on a used Good Humor truck and take to the streets to sell ice cream. That summer, you buy $1,000 worth of ice cream and re-sell it for $2,000. Congratulations -- you just made $1,000 in profits, but you are still $4,000 poorer after accounting for the cost of that truck.

The point is, great, safe companies are profitable AND make enough extra to cover their year-to-year investments that set the stage for future growth (known as capital expenditures, or CapEx).

[InvestingAnswers Feature: One-Hit Wonder Stocks You Wish You Could Forget]

Debt -- Manageable Vs. Problematic

Of course, even the most solid-seeming companies can run into trouble if they have weak balance sheets. In the economic crisis of 2008, a number of companies saw their stock prices plunge as investors began to realize that looming debt payments could force these companies into bankruptcy.

Some debt is good: Debt can be a useful tool to help lower tax bills or keep the number of outstanding shares from rising. But too much debt can spell trouble.

Looking at my list of 100 free-cash-flow kings, I decided to toss out any companies with debt equal to 50% or more of their cash levels. That means that if necessary, these companies could pay off their debt tomorrow and still have plenty of cash on the balance sheet.

After that constraint, my list dropped to just 38 companies.

Now, investors know that smaller companies -- no matter how strong they are -- will always be sold off in bear markets. So I narrowed the list down even further to companies with a market capitalization of at least $8 billion. "Big and safe" is the always the place to be when the going gets tough.

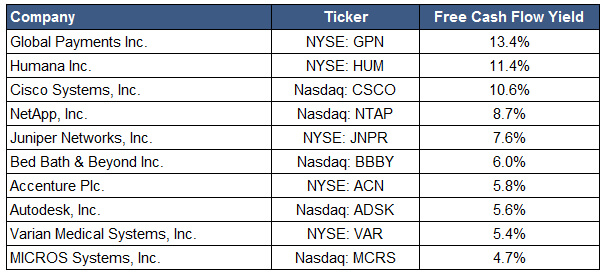

Finally, I wanted my final list to be those stocks that represent the best values right now. So, as an added twist, I ranked the remaining companies by their three-year average free-cash-flow yield. The higher the yield, the more free cash flow the company generates -- and that's a good thing.

Note that these companies were able to generate impressive cash flow during the recent weak economy. That means they are likely to look even more impressive as the economy gets healthier.

The Investing Answer: Every one of these companies has fattened its balance sheet with cash every year for the past 10 years, and it's quite likely they will continue to do so. With a track record like that, investors will be unlikely to dump them when the market crashes and other stocks are being unloaded. Even better, these stocks should rise alongside the next bull market once we work our way through these uncertain times.

This article orignally appeared at InvestingAnswers.com

Join the conversation as a VIP Member