I’ve had ample reason to praise Hong Kong’s economic policy.

Most recently, it was ranked (once again) as the world’s freest economy.

And I’ve shown that this makes a difference by comparing Hong Kong’s economic performance to the comparatively lackluster (or weak) performance of economies in the United States, Argentina, and France.

But perhaps the most encouraging thing about Hong Kong is that the nation’s top officials genuinely seem to understand the importance of small government.

Here are some excerpts from a recent speech delivered by Hong Kong’s Financial Secretary. He brags about small government and low tax rates!

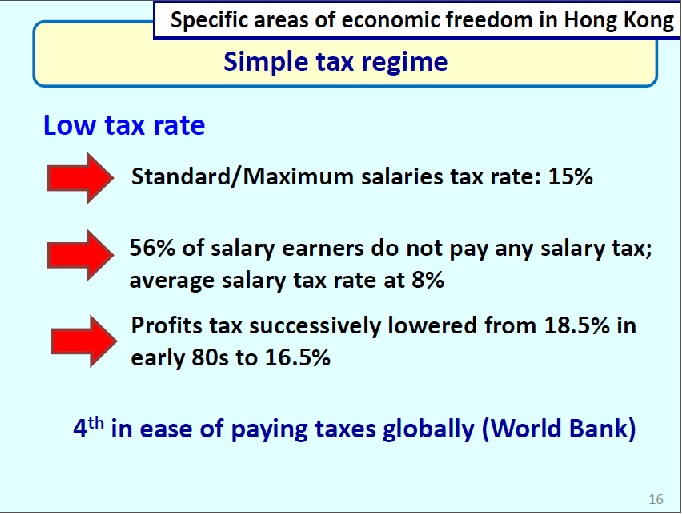

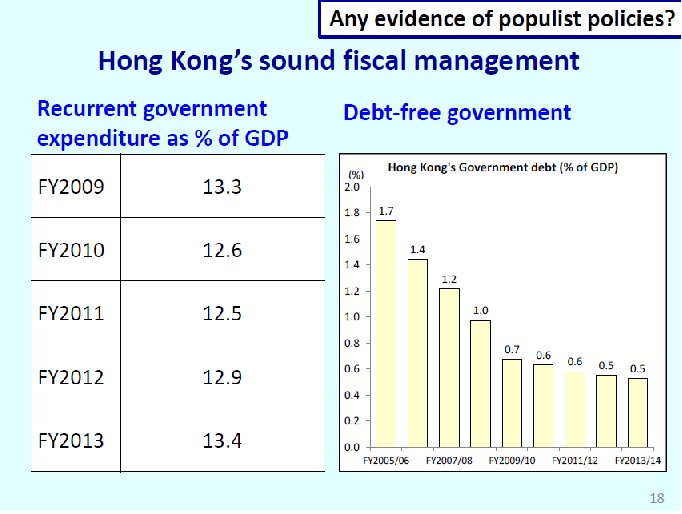

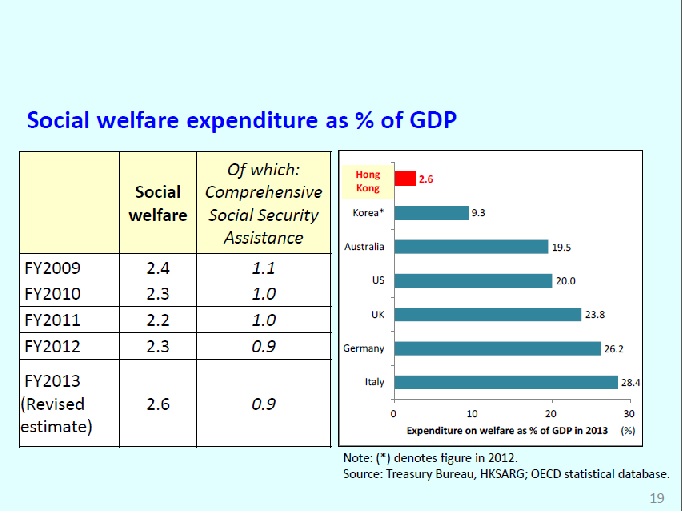

Hong Kong has a simple tax system built on low tax rates. Our maximum salaries tax rate is 15 per cent and the profits tax rate a flat 16.5 per cent. Few companies and individuals would find it worth the risk to evade taxes at this low level. And that helps keep our compliance and enforcement costs low. Keeping our government small is at the heart of our fiscal principles. Leaving most of the community’s income and wealth in the hands of individuals and businesses gives the private sector greater flexibility and efficiency in making investment decisions and optimises the returns for the community. This helps to foster a business environment conducive to growth and competitiveness. It also encourages productivity and labour participation. Our annual recurrent government expenditure has remained steady over the past five years, at 13 per cent of GDP. …we have not responded irresponsibly to…populist calls by introducing social policies that increase government spending disproportionally. …The fact that our total government expenditure on social welfare has remained at less than 3 per cent of our GDP over the past five years speaks volumes about the precision, as well as the effectiveness, of these measures.

Recommended

And he specifically mentions the importance of controlling the growth of government, which is the core message of Mitchell’s Golden Rule.

Our commitment to small government demands strong fiscal discipline….It is my responsibility to keep expenditure growth commensurate with growth in our GDP.

Is that just empty rhetoric?

Hardly. Here’s Article 107 from the Basic Law, which is “the constitutional document” for Hong Kong

The most important part of Article 107, needless to say, is that part of keeping budgetary growth “commensurate with the growth rate of its gross domestic product.”

The folks in Hong Kong don’t want to wind up like Europe.

Last year, I set up a Working Group on Long-term Fiscal Planning to conduct a fiscal sustainability health check. We did it because we are keenly aware of Hong Kong’s low fertility rate and ageing population, not unlike many advanced economies. And that can pose challenges to public finance in the longer term. A series of expenditure-control measures, including a 2 per cent efficiency enhancement over the next three financial years, has been rolled out.

And, speaking of Europe, he says the statist governments from that continent should clean up their own messes before criticizing Hong Kong for being responsible.

I would hope that some of those governments in Europe, those that have accused Hong Kong of being a tax haven, would look at the way they conduct their own fiscal policies. I believe they could learn a lesson from us about the virtues of small government.

Just in case you think this speech is somehow an anomaly, let’s now look at some slides from a separate presentation by different Hong Kong officials.

Here’s one that warmed my heart. The Hong Kong official is bragging about the low-tax regime, which features a flat tax of 15 percent!

But what’s even more impressive is that Hong Kong has a very small burden of government spending.

And government officials brag about small government.

By the way, you’ll also notice that there’s virtually no red ink in Hong Kong, largely because the government focuses on controlling the disease of excessive spending.

Why is government small?

In large part, as you see from the next slide, because there is almost no redistribution spending.

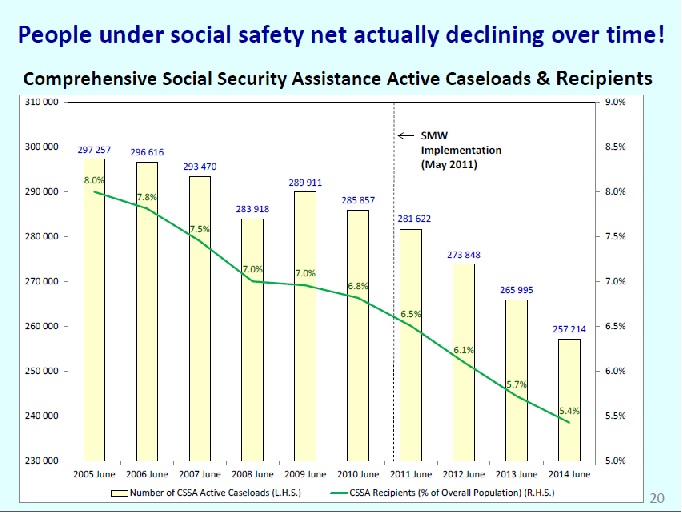

Indeed, officials actually brag that fewer and fewer people are riding in the wagon of dependency.

Can you imagine American lawmakers with this kind of good sense?

None of this means that Hong Kong doesn’t have any challenges.

There are protests about a lack of democracy. There’s an aging population. And there’s the uncertainty of China.

But at least for now, Hong Kong is a tribute to the success of free markets and small government.

Join the conversation as a VIP Member