As Americans continue to suffer from intransigent—not transitory—inflation, many theories have been floated concerning the roots of the 8.6 percent inflationary rate that is absolutely devastating the lower- and middle-classes.

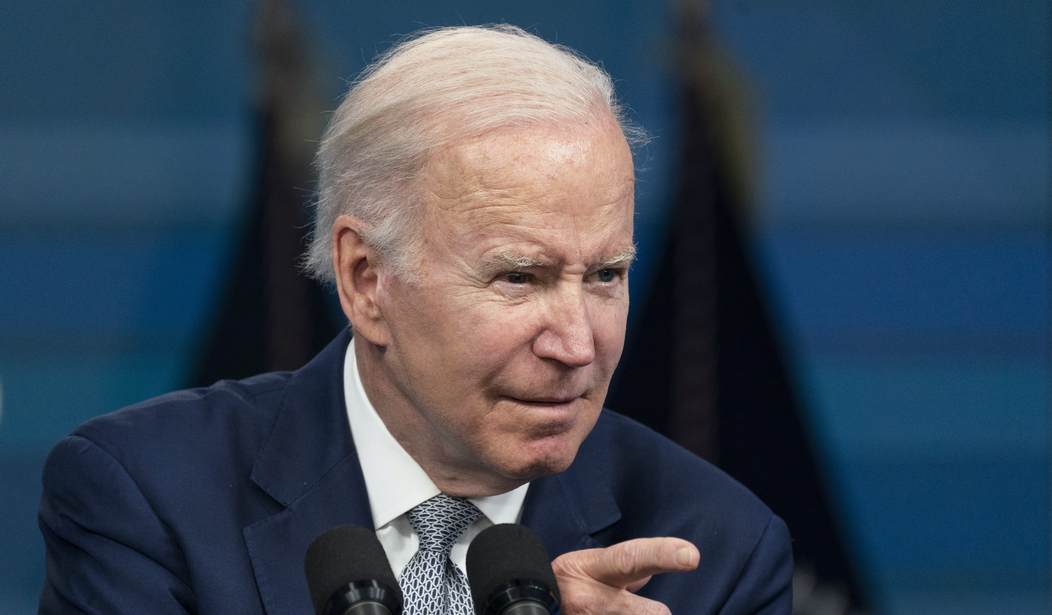

According to the Biden administration, blame for the worst rate of inflation in more than four decades lies with “Big Oil,” “Big Meat,” “Big Shipping,” and, of course, Vladimir Putin.

However, the American people are not buying Biden’s excuses for the runaway inflation they are enduring under his watch. In fact, most Americans pin the blame for out-of-control inflation on Biden and his misguided policies.

Fortunately, it seems as if the American people are quite a bit smarter than the Biden administration believes they are. Because when the rubber meets the road, there are two primary factors driving the awful inflation that is poisoning the U.S. economy.

Those factors are called modern monetary theory (MMT) and environmental, social, and governance (ESG) investing, which have both been fully embraced by the Biden administration.

In short, MMT posits that “a government can merge fiscal and monetary policy and simply print currency to pay for its expenditures indefinitely without economic costs or constraints,” according to the Federal Reserve Bank of Richmond.

In other words, MMT advocates, which include Treasury Secretary Janet Yellen, believe the U.S. government can print enormous sums of money to cover profligate government spending with no consequences. Apparently, these people do not grasp the basic economic concept that when the government spends and prints huge sums of money, the value of existing dollars plummets.

Recommended

As Milton Friedmann famously put it, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

In less than two years, Biden has gone all-in on MMT. From his $1.9 trillion American Rescue Plan to his $1.2 trillion “infrastructure” plan, Biden and the Democrat-controlled Congress have unleashed the federal spending spigot like never before. And, remember, Biden and Congress pleaded for another $5 trillion spending bonanza via the Build Back Better bill, which was thankfully stopped in its tracks by two brave Democratic senators.

Indeed, since taking office, the Biden administration has overseen the largest expansion in the U.S. money supply ever. In 18 months, the U.S. M2 money supply has grown by $6 trillion. To put into context, when Biden was inaugurated, the M2 money supply was $15.4 trillion. Today, it stands at $21.7 trillion.

Make no mistake, Biden’s MMT policies are promoting inflation based on the simple fact that printing trillions of dollars in a short span of time debases the currency, making each dollar less valuable.

While rampant money printing is arguably the primary force behind America’s roaring inflation, one should not overlook Biden’s war on U.S. energy production via his administration’s support of ESG investing.

In a nutshell, ESG investing is the epitome of crony capitalism because it empowers government and large financial institutions to collude in seeking preferred political and economic outcomes.

At the heart of ESG investing is the so-called “environmental” outcomes its overlords pursue, which conveniently rewards green energy projects while punishing fossil fuel producers by restricting access to capital.

In other words, ESG investing seeks to destroy the affordable and reliable fossil fuel industry through attrition warfare while flooding money into renewable energy sources that are more expensive and less reliable.

As Will Hares, an analyst at Bloomberg Intelligence, succinctly said, “Oil companies are finding it increasingly difficult to raise financing amid rising ESG and sustainability concerns, while banks are under pressure from their own investors to reduce or eliminate fossil-fuel financing.”

By arbitrarily reducing their access to capital, oil and gas companies are less able to engage in research and development, which means they produce less oil and gas. No wonder the United States is extracting less oil and gas than it did before the pandemic. And, no wonder the cost of energy, especially gasoline and diesel fuels, is skyrocketing at an absolutely dizzying rate.

Without a doubt, the rise in energy prices, due to ESG investing and Biden’s other anti-fossil fuel policies, is exacerbating inflationary measures and reducing Americans’ standard of living.

Fortunately, there is light at the end of the tunnel. Because our present bout of inflation is mostly due to MMT and ESG, we know it can be reversed.

Yes, it will not be easy and there will be more pain to come.

But, we have been in this boat before. In the late 1970s, the U.S. economy suffered through a similar inflationary period. Although the circumstances were not the same, similar principles were at play.

By the early 1980s, the inflationary dragon had been slayed via common sense economic policies of sound money, tax cuts, and regulatory reforms that spurred a two-decade economic boom.

We did it then. We can do it again. All we have to do is renounce those who are pushing the modern-day economic snake oil known as MMT and ESG investing.

Chris Talgo (ctalgo@heartland.org) is senior editor at The Heartland Institute.

Join the conversation as a VIP Member